Cash buyers are securing properties 6% below the average UK house price.

Research by national agent Jackson-Stops has revealed the regions where the most savings can be made by buying with cash.

Nationally, cash buyers are spending £21,384 or 8% more than a year ago to secure a property.

Those purchasing a property with a mortgage paid the highest premiums, spending £25,347 more than last year, indicating that cash buyers hold all the cards when it comes to price negotiation, the agency brand said.

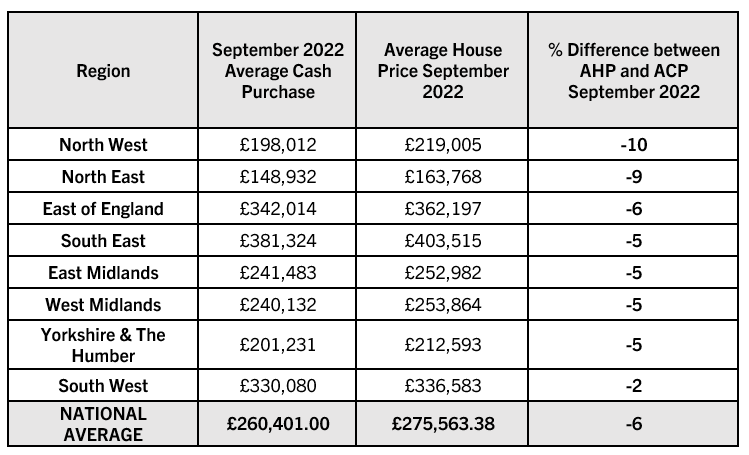

According to its analysis of Land Registry data in September 2022, cash buyers in the North West of England were able to negotiate a purchase price that is 10% below the average property price in the region.

This saving, which equates to £20,993 for the average cash purchaser in the area, is the highest percentage saving in the country and is 16% below than those purchasing using a mortgage.

The difference between what cash and mortgaged buyers paid for a property last year was lowest in the South West at 2%.

The agent said the appeal of cash buyers in the current market is particularly prevalent amid mortgage rate rises and expiring lending offers, which it suggests has contributed to a national rise in transaction delays and longer chains.

Figures show the time it takes from a buyer instructing a conveyancing firm to exchanging on a new property is now 90% longer in some parts of the country than in 2007, with a national average of 132 days per transaction, Jackson-Stops said.

Nick Leeming, chairman of Jackson-Stops, added: “It’s a cash buyers’ market. Not only are they pipping some mortgaged buyers to the post, but they’re often able to give sellers the quick sale that they are after in today’s less than certain mortgage market.

“A large proportion of today’s cash buyers are equity-rich baby boomers deciding that now is the time to downsize and live retirement with fewer bills and more financial agility.

“We expect this trend to continue as the UK market demographic goes through a significant shift, in which soon one in four people will be over 65. Many of these homeowners are choosing to take their next steps now and make a purchase that better reflects their future needs. These are lifestyle driven cash buyers who’ve typically built-up equity in the family home over several decades.”