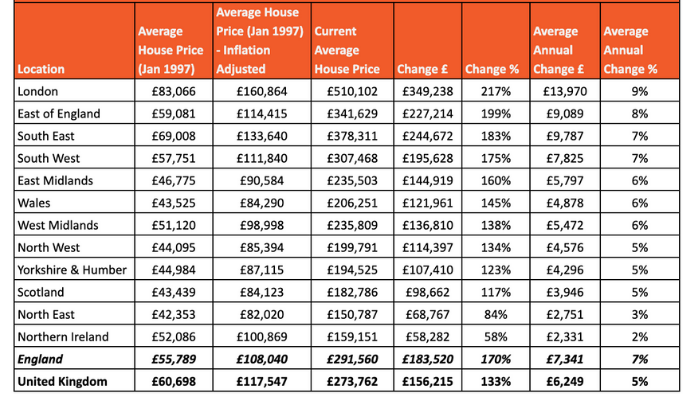

For investors who keep their buy to lets for substantial periods - up to 25 years in some cases - a new analysis shows where capital appreciation has been strongest.

Financial consultancy Henry Dannell looked at which region of the UK has been most profitable for investors.

Perhaps unsurprisingly, despite the poor performance during the pandemic, London tops the table.

Back in 1997, the average London home was valued at £83,066, or £160,864 after adjusting for inflation. Today, this has climbed to £510,102, an inflation adjusted uplift of £349,238 or 217 per cent.

That’s a huge average annual increase of £13,970 or nine per cent over a 25-year mortgage term.

Investors in the East of England have enjoyed the second largest increase in the value of their homes: house prices in the region are up 199 per cent in the last 25 years - an increase of £227,214.

However, when it comes to actual profit made on their property, those in the South East have seen a larger return.

The average value of a home in the region is up £244,672 or 183 per cent in the last 25 years once adjusted for inflation, an average increase of almost £10,000 every year.

The South West (175 per cent) and East Midlands (160 per cent) also rank amongst some of the strongest performing areas of the UK.

Even at the opposite end of the table, homeowners in Northern Ireland will have seen a 58 per cent or £159,151 increase in the value of their home over 25 years - an uplift of £2,331 each year.

“Although London house prices have stuttered during the pandemic in contrast to the far greater increases seen elsewhere around the UK, the region remains by far the best investment when it comes to long term market performance. Our expectation is that, following the recent blip in London house price performance, this market is likely to come back strongly in the short to medium term.”

Via @LandlordToday