Standing firm

2022 has started strongly. Sales volumes in January are predicted to be 10% higher than their long- term (2012–2021) average and, except for a year ago, are the strongest since 2007 (Dataloft, HMRC). Buyer demand remains steadfast, up 16% year-on-year (Rightmove). Property price growth continues to be sustained; annual price growth in the year to January was at its strongest in over 15 years (Nationwide). Rightmove reported the biggest monthly jump in the asking price of a newly listed property since 1994 and when asked, the majority of agents are still expecting price growth over the next three- and 12-month period.

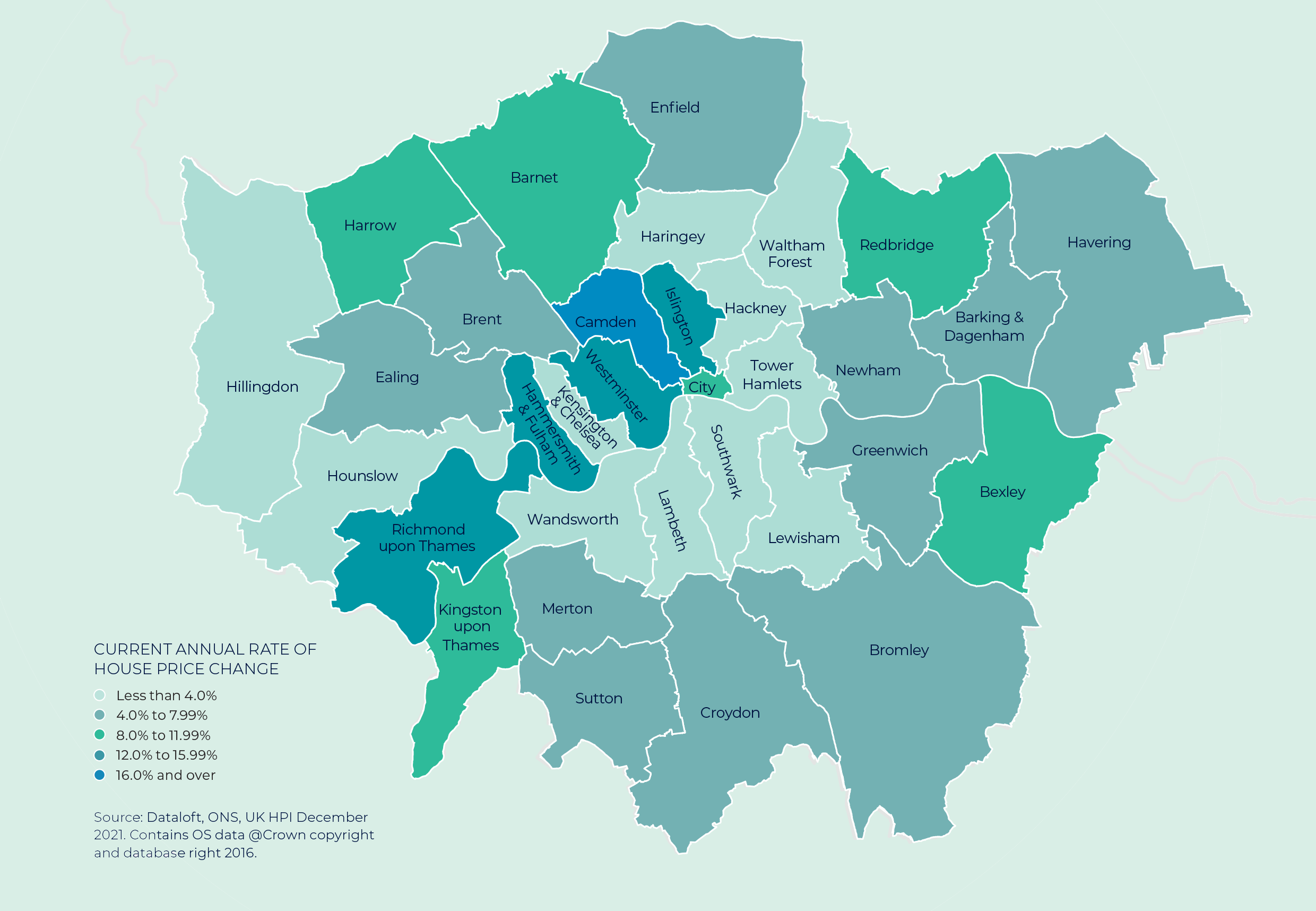

At 5.5%, annual property price growth in London is stronger than the 3.1% evident a year ago, albeit lower than other areas of the UK. With office returns and hybrid working now firmly in place, there has been renewed interest in living in the capital.

London remains a city of choice for many domestic and international purchasers, ranking highly in many global league tables. Considered the World’s Best City, Europe’s Best City to Visit, the Best City in which to Live and Work, and the Best City for students¹, London’s joie de vivre ensures it’s always in demand.

¹ Resonance, 2022, Trip Advisor, 2021, Boston Consulting Group, 2021, QS Best Student Cities, 2022

Winds of change

Although the quantity of property for sale remains low, with the Royal Institution of Chartered Surveyors (RICS) reporting stock levels per agent at a record low in January (barring the market closure in spring 2020), there are signs of change. New listings in January rose 11% year-on-year, with Rightmove noting a substantial rise in home valuation requests – an indication that many are looking to sell before they buy in current conditions. These should feed through to agents’ books over the coming months. Historically, March is the strongest time to sell, with the highest number of buyer enquiries per property for sale.

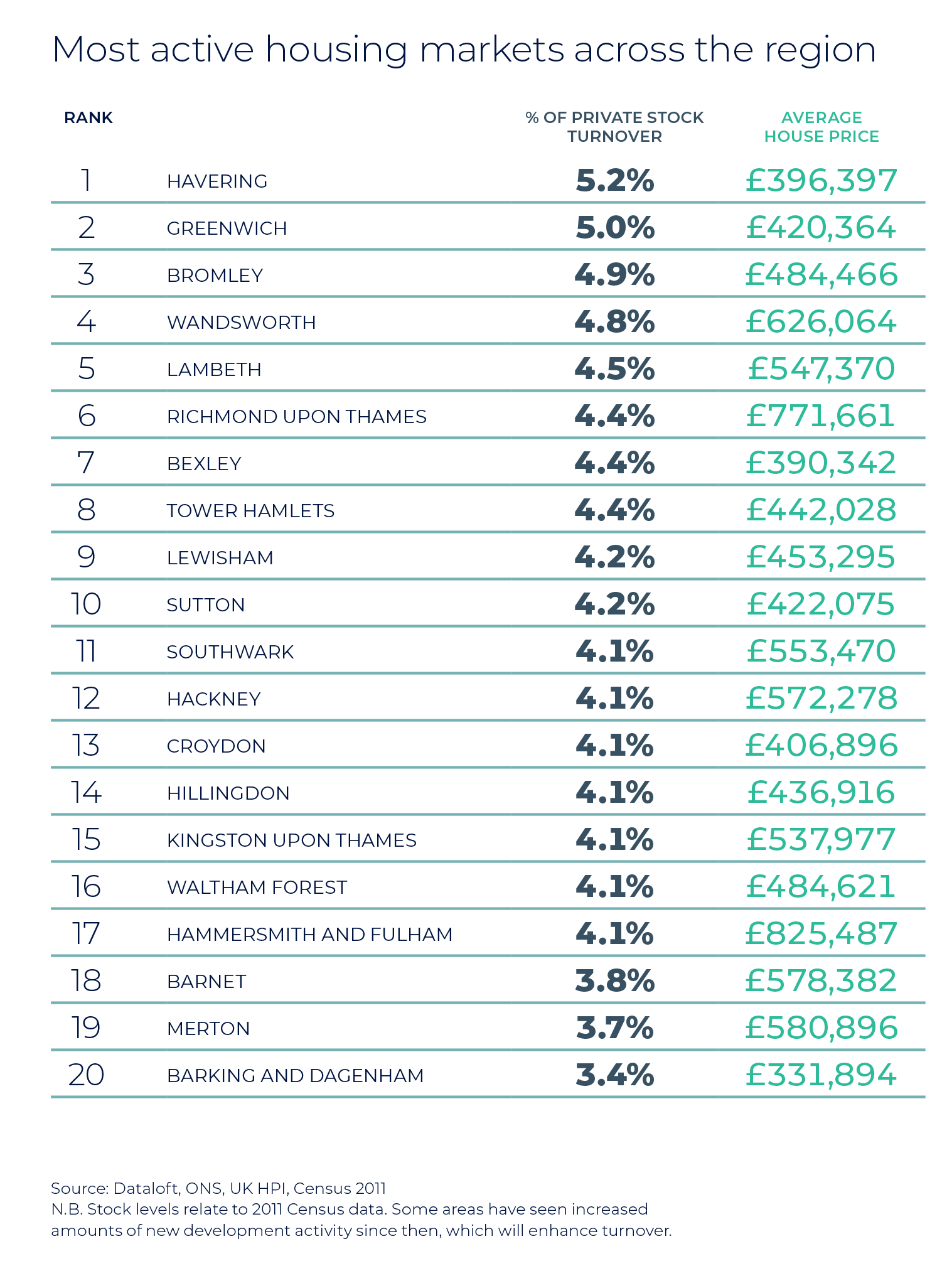

Havering and Greenwich proved the fastest-moving markets in London over the course of 2021, with more than one in every 20 privately owned properties estimated to have changed hands. 2022 has started with more momentum in the capital. At 68 days, the average time taken to sell a property is four days quicker than a year ago and nearly two weeks quicker than in January 2020.

Sunshine and showers

Across the UK, governments are announcing their plans for ‘living with COVID’ and hybrid working is bedding in. With economic growth of 7.5% over the course of 2021, the UK economy is close to its pre-pandemic level. However, consumer confidence remains on edge due to the rising cost of living. Increases in the cost of food and clothing, along with rising fuel and energy prices, look set to squeeze many household incomes. Savings made during the pandemic might provide a cushion in the short term, and while interest rates may well rise from the current 0.5%, they remain low by historic standards.

View The Full London Regional Report